Discover the striking similarities between the EB-5 and Opportunity Zones programs and how they can complement each other. In this article, we delve into their shared goals and complexities to provide insights for prospective investors.

Shared Goals: Community Revitalization

Both the EB-5 and Opportunity Zones programs share a common objective: infusing fresh capital into struggling communities. EB-5, often described as private equity with immigration benefits, and Opportunity Zones, essentially private equity with tax incentives, aim to uplift communities in need.

Navigating Regulatory Complexities

However, these incentives are not without their complexities. Both programs require applicants to navigate intricate regulatory requirements to gain approval for their projects. For EB-5 professionals accustomed to shepherding investors through complex ventures, this experience positions them well to handle Opportunity Zone projects.

Experience Matters

Regional centers with a history of attracting EB-5 investments have the expertise needed to develop Opportunity Zones funds successfully. Their track record makes them well-equipped to tap into this new funding source.

Parallel Investments in Real Estate

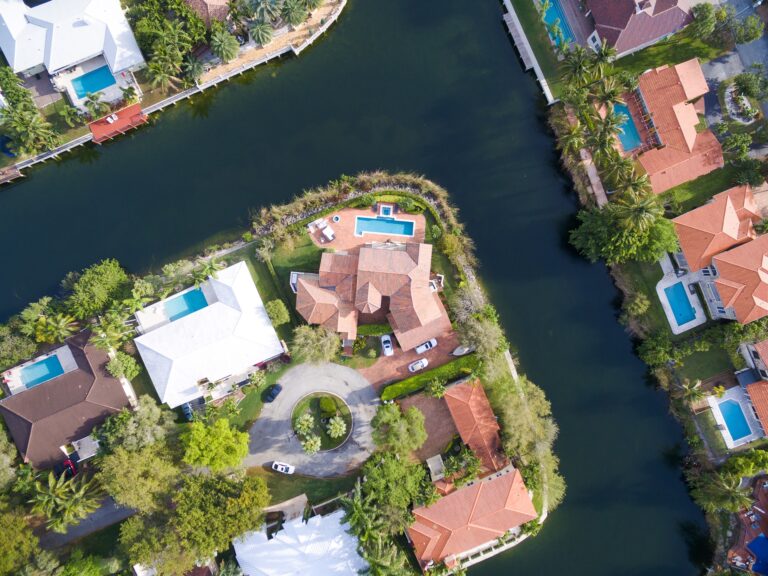

Another striking parallel between the two programs is their focus on high-end real estate businesses, which have historically attracted EB-5 investors worldwide. Early-stage Opportunity Zone projects often align with the sectors that have piqued the interest of EB-5 investors.

Tax Benefits and Eligibility

While the programs share many similarities, not all EB-5 investors can enjoy the tax benefits of the Opportunity Zones program. To capitalize on these benefits, investors must have taxable gains in the United States, excluding first-time investors. However, foreign investors who already own assets in the U.S. may still access these tax advantages when investing in an EB-5 project.

An Opportunity for EB-5 Developers

For EB-5 developers, the Opportunity Zones program offers an exciting new funding source. Many Opportunities Zones coincide with EB-5’s targeted employment areas, allowing developers to secure funding through both programs. However, this opportunity is limited to predetermined Opportunity Zone Census tracts, where substantial benefits await.

Potential Synergies and Qualifications

It’s worth noting that the Opportunity Zones program only benefits properties acquired after December 31, 2017. This may lead some EB-5 investors to divest portions of existing developments to third parties for Opportunity Zone fundraising. In such cases, EB-5 investors can still retain up to a 20% ownership stake in the repackaged developments.

Reducing Risk through Synergy

In many instances, an EB-5 investment can substantially improve the prospects for an Opportunity Zone investor, and additional Opportunity Zone equity can mitigate risk for EB-5 investors.

Disclosure and Mutual Benefit

When utilizing both programs, disclosing potential conflicts of interest is essential. Fortunately, as these deals benefit both parties, this disclosure should not pose a significant burden.

This underscores the importance of hiring an experienced Business Attorney. The legal experts at Jurado & Associates, P.A., are here to ensure your investments maximize their potential.

For further information about our services, please contact us at (305) 921-0976, reach out to us via WhatsApp at +1 (305) 921-0976, or send us an email at [email protected].